charitable gift annuity rates

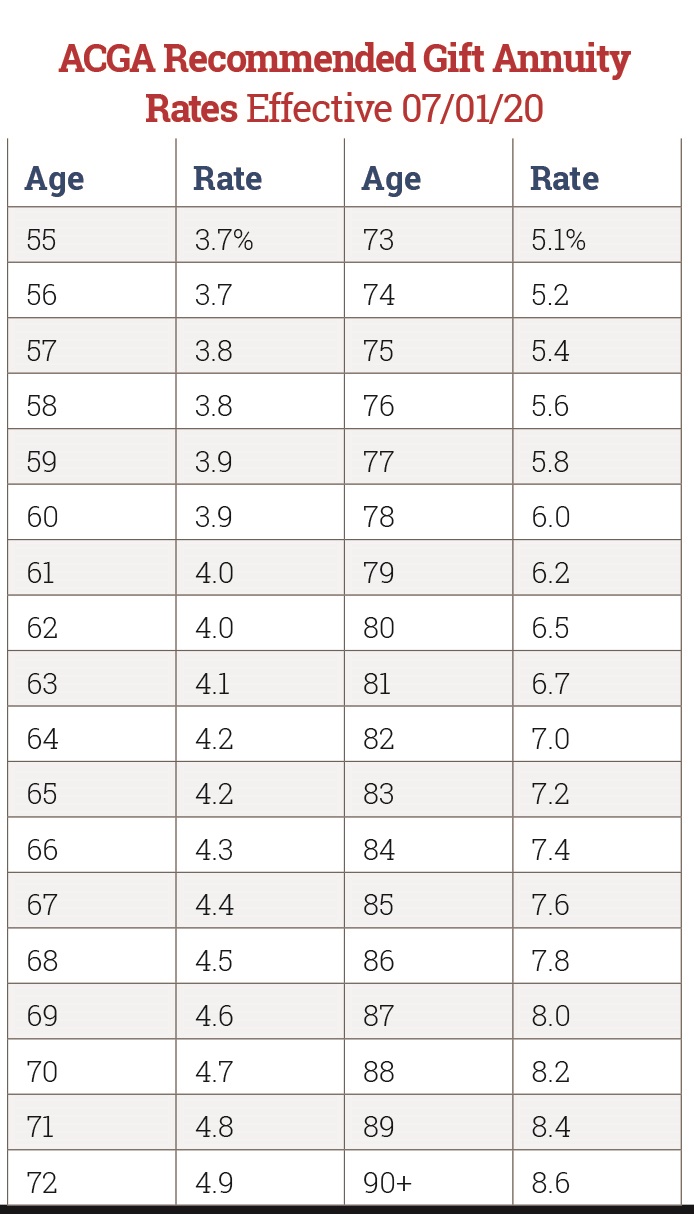

The rates for charitable gift annuities are often lower than those offered by insurance. The ACGA reviews its annuity rate tables periodically to see if they need adjusting.

Prepare To Retire With A Gift Annuity Kiplinger

The ACGA sets rates with the goal that on average about 50 of the gift amount will remain.

. 7 rows Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Single Life Rates Effective July 1 2020.

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Ad Fixed rate annuity Rates. Grow Your Money With An Online Multi-Year Guaranteed Annuity MYGA.

Ad Want a Safer Way to Invest in Your Financial Future. Approved by the American Council on Gift Annuities on May 7 2020. Ad Build your Career in Data Science Web Development Marketing More.

Effective on July 1 2020. Invest 2-3 Hours A Week Advance Your Career. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

Huge inventory best rates. Fisher Investments warns retirees about annuities. Fisher Investments warns retirees about annuities.

The American Council on Gift Annuities ACGA recently announced new suggested maximum charitable gift annuity rates effective July 1 2020. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout. Ad Earn Lifetime Income Tax Savings.

Flexible Online Learning at Your Own Pace. Charitable Gift Annuity Rates Rates Effective as of January 1 2012 SINGLE LIFE AGE RATE AGE RATE AGE RATE AGE RATE 55 56 57 58 59 60 61 62 63 40 41 41 42 43 44 44. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

7 rows Immediate Payment Annuity current rates Age. Give Gain With CMC. Two Lives Joint Survivor Younger Age Older Age Rate.

For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate of 78 paying 780 annually for the same. Compare Fixed Variable Rate Annuity Accounts. Online provider of income annuities fixed annuities and the Personal Pension.

Ad Free quotes from top-tier companies no phone number required. See Finance Institutions With Top Offers. Learn how retirees are securing their retirement portfolios with fixed-deferred annuities.

In the case of immediate income annuities to donors in their seventies or older the charity may. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Go ahead and give us a call toll free at 800-535-4720 for a Free rate quote based on the income beneficiaries you want the.

A Charitable Annuity can also be established for joint lives. Charities must use the gift. Annuities May be the Answer.

125 rows For immediate gift annuities these rates will result in a charitable deduction of more than 10 if the CFMR is 06 or higher whatever the payment frequency. Suggested Charitable Gift Annuity Rates. The minimum required gift for a charitable gift annuity is 10000.

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Charitable Gift Annuity Rate Increases Texas A M Foundation

The Charitable Gift Annuity Capuchin Franciscan Province Of St Joseph

Acga Charitable Gift Annuity Rates

Charitable Gift Annuity Rates To Become More Attractive July 2018 Alabama West Florida United Methodist Foundation

Compelling Stories Market Charitable Gift Annuities Most Effectively

Article Jobs Asperger S A Plus Aspergers Job How To Apply

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home